Careful analysis reveals the nuance.

If you’re in California, you’ll have heard the industry chatter in the wake of the recent CPUC decision regarding net energy metering. The transition from NEM2.0 to NEM3.0 (Net metering to Net billing, per the state) has been approved, and customers are clamoring to get their paperwork filed by April 14, 2023 so they can be grandfathered into NEM2.0.

We have discussed net metering’s definition, history, and planned changes in previous entries. At VECKTA, we are starting to see decision-makers reconsider their timeline due to the slated changes, and many in the solar space are pushing consumers hard to sign today or get left behind. Instead of rushing in, we advocate for a more balanced approach, while still moving quickly enough to avoid missing the cutoff if there is value there for you. We have developed a methodology to accurately capture the projected value of NEM3.0 for a given site, and compare it to NEM2.0. We’ve done this work with a few customers, and are sharing a case study with you today to get to the bottom of how accurate the industry has been throughout this NEM2.0 PR push.

We recently completed an analysis for a C&I customer. The resulting insights challenge the current dominant narrative which tends to oversimplify the relationship between the shift to NEM3.0 and onsite project potential.

Here’s a high level overview of a project using the VECKTA platform to analyze various options:

2022 Annual Energy Spend

Anticipated Annual Energy Spend in 20 yrs

In terms of Levelized Cost of Energy (LCOE)–the discounted cost per unit of energy supplied ($/kWh) over the project life–the customer is expected to pay $0.2638/kWh over the next 20 years if they stick with utility as their sole provider.

Utility Service from Southern California Edison (A)

Peak Load (kW)

Square feet of roof space available for solar installation

To keep things simple, we are going to focus on the economic (cost-savings) benefits only, and set aside the emissions reduction and resilience benefits from building onsite solar and battery storage.

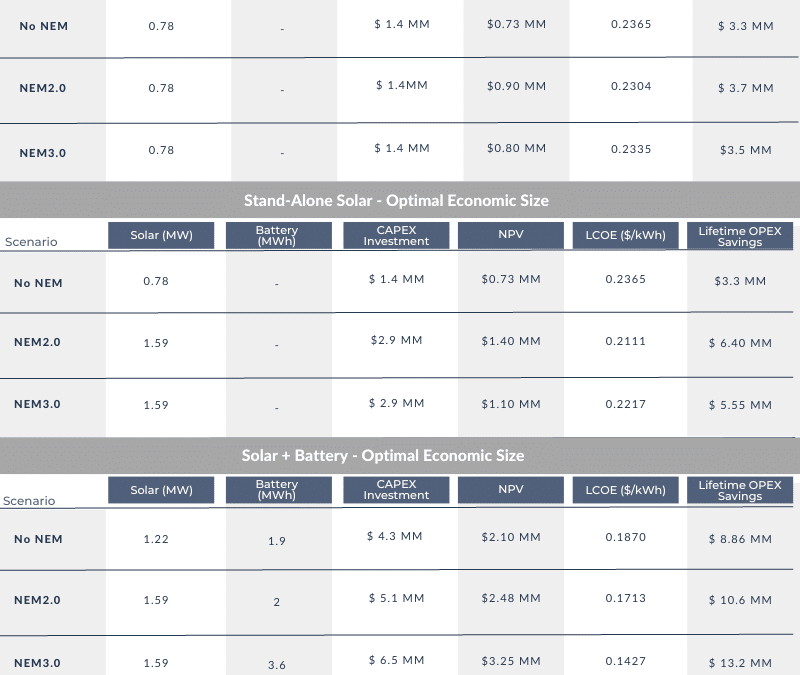

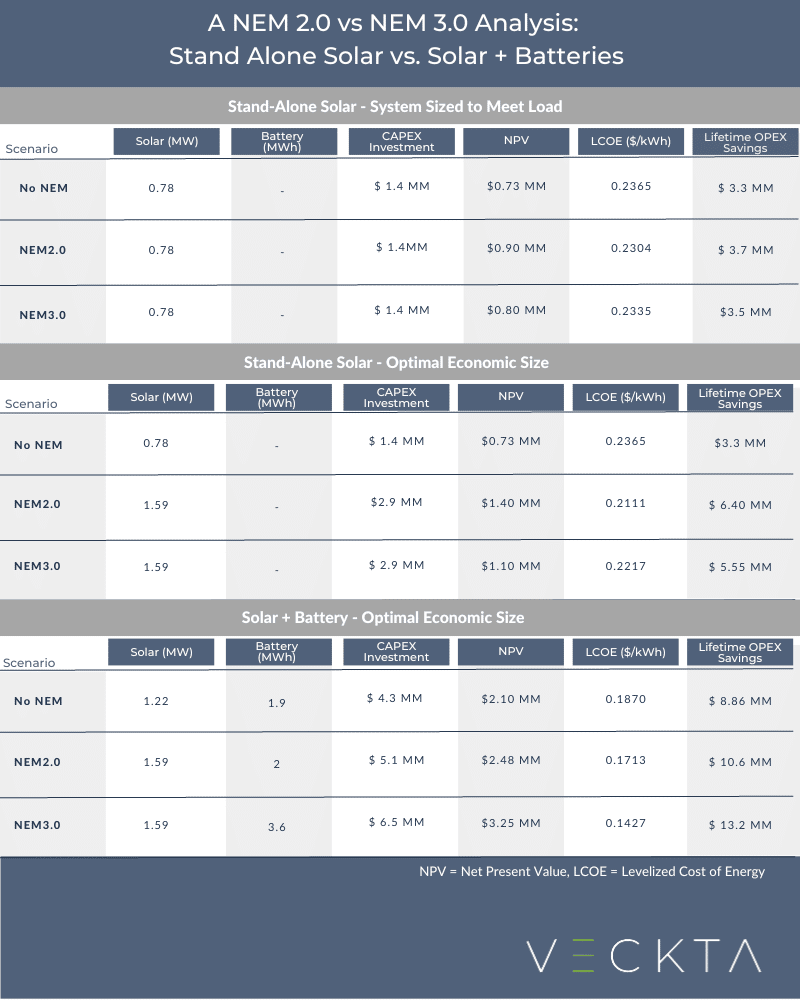

We are going to take a look at three scenarios:

- Stand-Alone Solar, System Sized to Meet Load: The solar system is sized to meet the load, instead of being oversized for the potential extra value through energy exports

- Stand-Alone Solar, System Sized for Optimal Economic Size: The solar system is sized to maximize economic returns, and is not limited to only serving the site’s load

- Solar + Battery, Optimal Economic Size: The solar system is allowed to be paired with a battery, and the overall system is sized to maximize economic returns

Across these 3 scenarios, we model a system that does not export surplus solar generation (No NEM), a system that is grandfathered into NEM2.0, and a system thats operates under NEM3.0. As you’ll see, this will let us draw insights about what is really valuable, depending on the context.

Solar Only Installations in CA: NEM2.0 > NEM3.0 > NO NEM

While the project is attractive regardless of incentive scheme, the industry is correct that stand-alone solar projects will diminish in value with the transition to NEM3.0. However, this kind of one-size-fits all statement somewhat ignores an important nuance, which is: The degree to which this matters for your project depends on your specific circumstances. Some of the variables to consider include:

- Load shape and size

- Increases in Utility Time of Use rates during peak periods

- Area available for solar installation

- Utility feeder infrastructure

- Appetite to make a larger investment

So, let’s look a little closer:

In this case, if you want to size a solar system to meet your 700kW load, the results indicate that the incentive structure will not make or break your project. In percentage terms, compared to a project which cannot partake in any net metering, the NEM2.0 project has a 10% greater net present value (NPV) than the NEM3.0 project, but lifetime savings will be very similar.

If your focus is maximizing returns with stand-alone solar, and you have the risk appetite to rely on surplus exports to make the system’s economics more valuable, you should utilize all available installation space to build a 1.59MW system. NEM2.0 becomes much more important for this system. In this case, you will leave nearly $1 million of savings on the table if you miss out on being grandfathered into NEM2.0.

Most interestingly however, this project reveals that it’s important to assess beyond stand-alone solar. With storage in the mix, regardless of the net metering scheme modeled, the investment value is projected to 2-3x greater depending on what you’re comparing to. In line with CPUC’s stated intentions to make battery storage more attractive, the largest battery system is picked for the scenario which includes NEM3.0, a result of the model reacting to the updated price signals. Notice that savings compared to solar only systems are significantly greater.

The ultimate insight is not that you should rush to build a stand-alone solar system and get grandfathered into NEM2.0. The insights are:

- If you want to minimize your CAPEX investment yet gain the most value, Solar only under NEM2.0 is the best option and you start the process immediately

- Solar + Batteries are worth more than any net metering

- Even the no NEM solar + battery project has better-projected economics than any of the other stand-alone projects

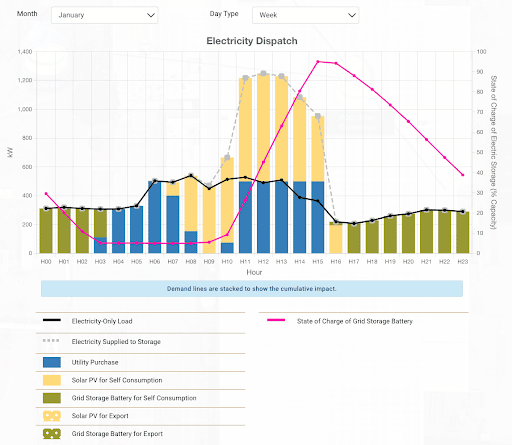

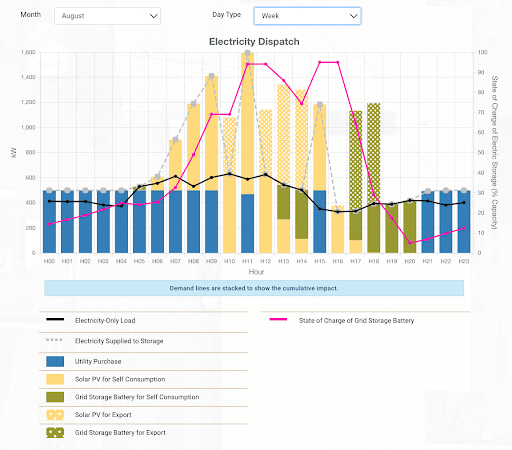

- NEM3.0 is best for a system that includes a battery. See below for the Solar + Battery system dispatch under NEM3.0

Winter Day

Summer Day

Looking at the whole picture, you might assume it’s a simple decision to just pick the NEM3.0 option and maximize potential economic returns; however, these additional returns require significant additional capital costs. This overview is just scratching the surface of the complexity attached to these savings opportunities, there’s a lot to consider when assessing whether rushing to be grandfathered into NEM2.0 is worthwhile. VECKTA is the clear choice for evaluating your options based on your own unique business, goals, and current market conditions. We can do it quickly enough that you can still get NEM2.0 if that’s what turns out to be the best for your specific project.